Mesa Air Group, Inc. today reported second quarter fiscal 2022 financial and operating results.

Financial Summary Q2:

- Pre-tax loss of $55.2 million, net loss of $42.8 million or $(1.19) per diluted share.

- Adjusted net loss1 of $10.3 million or $(0.29) per diluted share.

- Adjusted net loss excludes a $39.5 million (pre-tax) non-cash charge related to 12 CRJ aircraft held for sale.

Quarter Highlights:

- Mesa took delivery of its third 737-400F freighter aircraft in the quarter.

- Added an additional E175 flight simulator.

Fiscal Year Q2 Results:

Mesa’s Q2 FY22 results reflect a net loss of $42.8 million, or $(1.19) per diluted share, compared to net income of $5.7 million, or $0.14 per diluted share for Q2 FY21. Mesa’s Q2 FY22 adjusted pre-tax loss1 was $13.1 million versus an adjusted pre-tax income1 of $12.1 million in Q2 FY21. The year over year decrease in adjusted pre-tax income of $25.2 million was primarily due to lower block hours and the impact of the PSP program.

Jonathan Ornstein, Chairman and CEO, said, “While demand for our product remains strong, our financial results this quarter reflect the ongoing challenge of heightened pilot attrition. In January, our operational and financial performance was significantly impacted by Covid-related higher pilot absence rates which have since subsided. We remain focused on taking steps to address pilot attrition, including increased hiring, simulator capacity, and training capabilities, which has been exacerbated by the industry wide pilot shortage.”

Fiscal Q2 details:

Total operating revenues in Q2 2022 were $123.2 million, an increase of $25.9 million (26.7%) from $97.3 million for Q2 2021. Contract revenue increased $30.3 million. This was due to the return to normal rates from our partners which were temporarily reduced last year related to the PSP program. These were partially offset by a reduction in block hours. Mesa’s Q2 2022 results include, per GAAP, the recognition of $0.8 millionof previously deferred revenue, versus the deferral of $4.9 million of revenue in Q2 2021. The remaining deferred revenue balance will be recognized as flights are completed over the remaining terms of the contracts.

Mesa’s Adjusted EBITDA1 for Q2 2022 was $15.8 million, compared to $41.5 million in Q2 2021, and Adjusted EBITDAR1 was $25.2 million for Q2 2022, compared to $51.5 million in Q2 2021.

Operationally, the Company ran a controllable completion factor of 96.8% for American and 96.7% for United during Q2 2022. This is compared to a controllable completion factor of 99.8% for American and 100.0% for United during Q2 2021. This excludes cancellations due to weather and air traffic control. As Covid-related cancellations declined, our controllable completion factors for both American and United were both 99.9% for the month of March.

With respect to a total completion factor that includes all cancellations, Mesa reported a total completion factor of 93.5% for American and 93.7% for United during Q2 2022. This is compared to a total completion factor of 95.0% for American and 94.2% for United during Q2 2021.

1 See Reconciliation of non-GAAP financial measures

Liquidity and Capital Resources:

Mesa ended the quarter at $75.9 million in unrestricted cash and equivalents. As of March 31, 2022, the Company had $652.0 million in total debt secured primarily with aircraft and engines.

Fleet:

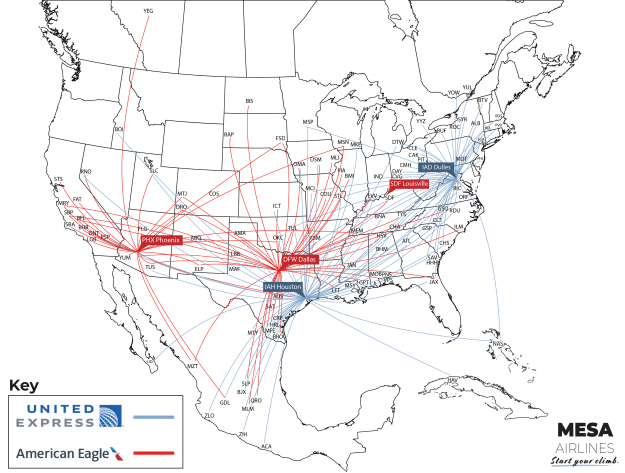

For the three months ended March 31, 2022, 47% of the Company’s total revenue was derived from our contracts with United, 46% from American, 1% from DHL, and 6% from leases of aircraft to a third party.

Below is our current and future fleet plan by partner and fleet type for FY22:

| Fleet Plan (FY22) |

Q1 (Dec ’21) |

Q2 (Mar ’22) |

Q3 (Jun ’22) |

Q4 (Sep ’22) |

|

Actual |

Actual |

Forecast |

Forecast |

| E-175 – UA |

80 |

80 |

80 |

80 |

| CRJ-900 – AA |

40 |

40 |

40 |

40 |

| 737-400F – DHL |

2 |

3 |

3 |

3 |

| Sub-total |

122 |

123 |

123 |

123 |

| CRJ-700 Leased |

17 |

18 |

20 |

20 |

| CRJ-700 to be Leased |

|

|

|

|

| to Third party |

3 |

2 |

– |

– |

| CRJs Spares/Parked |

25 |

13 |

13 |

13 |

| CRJs Held for Sale |

– |

12 |

12 |

12 |

| Total Fleet |

167 |

168 |

168 |

168 |

1Reconciliation of non-GAAP financial measures

Although these financial statements are prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”), certain non-GAAP financial measures may provide investors with useful information regarding the underlying business trends and performance of Mesa’s ongoing operations and may be useful for period-over-period comparisons of such operations. The tables below reflect supplemental financial data and reconciliations to GAAP financial statements for the three and six months ended March 31, 2022 and March 31, 2021. Readers should consider these non-GAAP measures in addition to, not a substitute for, financial reporting measures prepared in accordance with GAAP. These non-GAAP financial measures exclude some, but not all items that may affect the Company’s net income or loss. Additionally, these calculations may not be comparable with similarly titled measures of other companies.

1Reconciliation of GAAP versus Non-GAAP Disclosures

(In thousands, except for per diluted share) (Unaudited)

|

Three Months Ended March 31, 2022 |

|

Three Months Ended March 31, 2021 |

|

Income (Loss) Before Taxes |

Income Tax (Expense)/ Benefit |

Net Income (Loss) |

Net Income (Loss) per Diluted Share |

|

Income Before Taxes |

Income Tax (Expense)/ Benefit |

Net Income |

|

Net Income per Diluted Share |

| GAAP Income (Loss) |

$ |

(55,165 |

) |

12,382 |

|

(42,783 |

) |

$ |

(1.19 |

) |

|

$ |

7,579 |

|

(1,890 |

) |

5,689 |

|

$ |

0.14 |

| Adjustments (1) (2) (3) |

|

39,843 |

|

(9,097 |

) |

30,746 |

|

$ |

0.85 |

|

|

|

4,508 |

|

(1,124 |

) |

3,384 |

|

$ |

0.09 |

| Loss on Investments, Net (4) |

|

2,261 |

|

(522 |

) |

1,739 |

|

$ |

0.05 |

|

|

|

|

|

|

|

| Adjusted Income (Loss) |

|

(13,061 |

) |

2,763 |

|

(10,298 |

) |

$ |

(0.29 |

) |

|

|

12,087 |

|

(3,014 |

) |

9,073 |

|

$ |

0.23 |

|

|

|

|

|

|

|

|

|

|

|

| Interest Expense |

|

8,120 |

|

|

|

|

|

|

8,755 |

|

|

|

|

|

| Interest Income |

|

(42 |

) |

|

|

|

|

|

(79 |

) |

|

|

|

|

| Depreciation and Amortization |

|

20,747 |

|

|

|

|

|

|

20,705 |

|

|

|

|

|

| Adjusted EBITDA |

|

15,764 |

|

|

|

|

|

|

41,468 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aircraft Rent |

|

9,434 |

|

|

|

|

|

|

9,992 |

|

|

|

|

|

| Adjusted EBITDAR |

$ |

25,198 |

|

|

|

|

|

$ |

51,460 |

|

|

|

|

|

(1) Includes adjustment for lease termination expense of $4.5 million for the three months ended March 31, 2021 related to the purchase of a CRJ-900 aircraft, which was previously leased from Bombardier Capital.

(2) Includes adjustment for impairment charges of $39.5 million for the three months ended March 31, 2022 related to certain of the Company’s aircraft which are classified as held for sale.

(3) Includes adjustment for operating lease right of use asset impairment charges of $0.4 million during the three months ended March 31, 2022 related to the abandonment of one of the Company’s leased facilities.

(4) Includes losses resulting from changes in the fair value of the Company’s investments in equity securities of $2.3 million for the three months ended March 31, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended March 31, 2022 |

|

Six Months Ended March 31, 2021 |

|

Income (Loss) Before Taxes |

Income Tax (Expense)/ Benefit |

Net Income (Loss) |

Net Income (Loss) per Diluted Share |

|

Income Before Taxes |

Income Tax (Expense)/ Benefit |

Net Income

|

Net Income per Diluted Share |

| GAAP Income (Loss) |

$ |

(73,551 |

) |

16,494 |

|

(57,057 |

) |

$ |

(1.58 |

) |

|

$ |

26,518 |

|

(6,711 |

) |

19,807 |

|

$ |

0.52 |

| Adjustments (1)(2)(3)(4) |

|

39,843 |

|

(9,097 |

) |

30,746 |

|

$ |

0.85 |

|

|

|

3,558 |

|

(900 |

) |

2,658 |

|

$ |

0.07 |

| Loss on Investments, Net (5) |

|

8,723 |

|

(1,992 |

) |

6,731 |

|

$ |

0.19 |

|

|

|

|

|

|

|

| Adjusted Income (Loss) |

|

(24,985 |

) |

5,405 |

|

(19,580 |

) |

$ |

(0.54 |

) |

|

|

30,076 |

|

(7,611 |

) |

22,465 |

|

$ |

0.59 |

|

|

|

|

|

|

|

|

|

|

|

| Interest Expense |

|

16,050 |

|

|

|

|

|

|

17,837 |

|

|

|

|

|

| Interest Income |

|

(93 |

) |

|

|

|

|

|

(205 |

) |

|

|

|

|

| Depreciation and Amortization |

|

41,775 |

|

|

|

|

|

|

41,175 |

|

|

|

|

|

| Adjusted EBITDA |

|

32,747 |

|

|

|

|

|

|

88,883 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aircraft Rent |

|

19,020 |

|

|

|

|

|

|

20,040 |

|

|

|

|

|

| Adjusted EBITDAR |

$ |

51,767 |

|

|

|

|

|

$ |

108,923 |

|

|

|

|

|

(1) Includes adjustment for gain on extinguishment of debt of $1.0 million related to repayment of the Company’s aircraft debts during the six months ended March 31, 2021.

(2) Includes adjustment for lease termination expense of $4.5 million for the six months ended March 31, 2021 related to the purchase of a CRJ-900 aircraft, which was previously leased from Bombardier Capital.

(3) Includes adjustment for impairment charges of $39.5 million for the six months ended March 31, 2022 related to certain of the Company’s aircraft which are classified as held for sale.

(4) Includes adjustment for operating lease right of use asset impairment charges of $0.4 million during the six months ended March 31, 2022related to the abandonment of one of the Company’s leased facilities.

(5) Includes losses resulting from changes in the fair value of the Company’s investments in equity securities of $8.7 million for the six months ended March 31, 2022.

Mesa Airlines aircraft photo gallery:

Like this:

Like Loading...

You must be logged in to post a comment.