Southwest Airlines Company today reported its first quarter 2024 financial results:

- Net loss of $231 million, or $0.39 loss per diluted share

- Net loss, excluding special items1, of $218 million, or $0.36 loss per diluted share

- Record first quarter operating revenues of $6.3 billion

- Liquidity2 of $11.5 billion, well in excess of debt outstanding of $8.0 billion

Bob Jordan, President and Chief Executive Officer, stated, “While it is disappointing to incur a first quarter loss, we exited the quarter with healthy profits and margins in the month of March. We are focused on controlling what we can control and have already taken swift action to address our financial underperformance and adjust for revised aircraft delivery expectations. I want to thank our more than 74,000 Employees for their continued Warrior Spirit to maintain a reliable and resilient operation as we adapt to aircraft delivery constraints and adjust to slower than planned growth for this year and next.

“Our first quarter 2024 revenue performance, while shy of our prior aspirations, resulted in record first quarter operating revenues, record first quarter passengers carried, and a solid sequential improvement in nominal unit revenue when compared with seasonal norms. The sequential improvement was driven by an acceleration in managed business revenues as well as benefits from network adjustments, which started in earnest with the March schedule. While costs remain a headwind, we are realizing benefits from our ongoing cost reduction actions and remain focused on enhancing productivity and controlling discretionary spending. We also have certainty with labor rates, having ratified agreements with 11 of our labor groups in the past 18 months, including the agreement ratified yesterday for our Flight Attendants.

“Achieving our financial goals is an immediate imperative. The recent news from Boeing regarding further aircraft delivery delays presents significant challenges for both 2024 and 2025. We are reacting and replanning quickly to mitigate the operational and financial impacts while maintaining dependable and reliable flight schedules for our Customers.

“To improve our financial performance, we have intensified our network optimization efforts to address underperforming markets. Consequently, we have made the difficult decision to close our operations at Bellingham International Airport, Cozumel International Airport, Houston’s George Bush Intercontinental Airport, and Syracuse Hancock International Airport. I want to sincerely thank our Employees, the airports, and the communities for all their incredible support over the years.

“Additionally, we are evaluating options to enhance our Customer Experience as we study product preferences and expectations, including onboard seating and our cabin. And, we are implementing cost control initiatives, including limiting hiring and offering voluntary time off programs. We now expect to end 2024 with approximately 2,000 fewer Employees as compared with the end of 2023.

“We are focused on achieving our financial prosperity goals and creating value for our Shareholders, while we adjust to changes in our aircraft delivery plans, Customer travel patterns and preferences, higher fuel prices, and other cost pressures. We are excited and optimistic with a robust set of strategic initiatives that are well underway. They are comprehensive and aimed at enhancing the Customer Experience; delivering operational excellence; creating new and meaningful revenue opportunities; expanding margins; and achieving return on invested capital well above of our weighted average cost of capital. We look forward to sharing these plans at our Investor Day in September.”

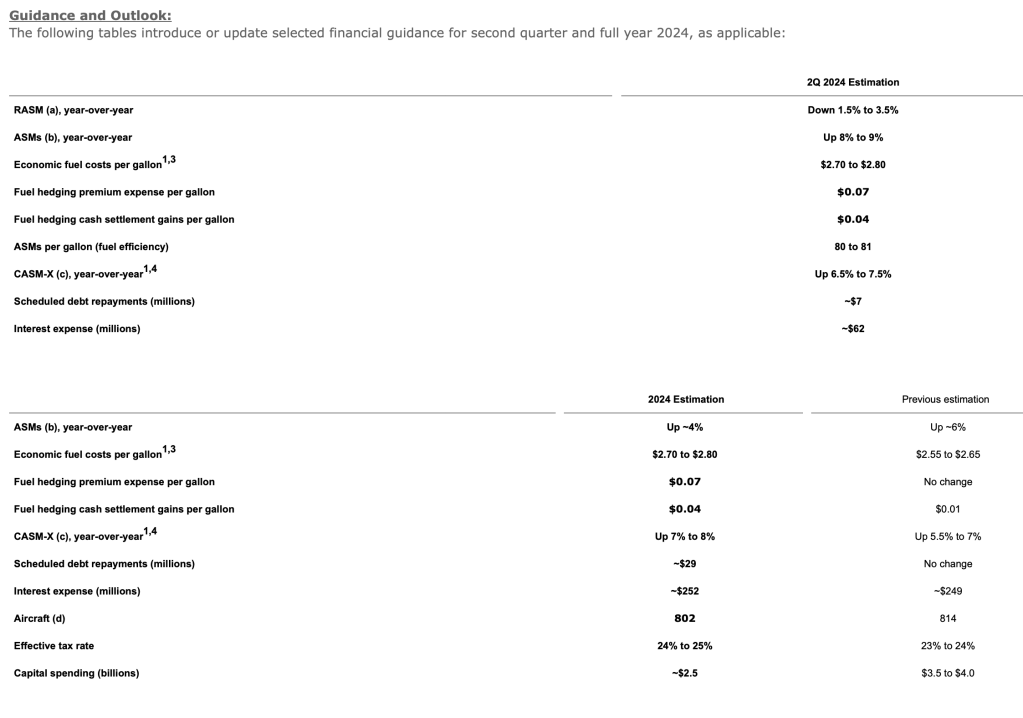

| (a) Operating revenue per available seat mile (“RASM” or “unit revenues”). |

| (b) Available seat miles (“ASMs” or “capacity”). The Company’s flight schedule is published for sale through March 5, 2025. The Company expects third quarter 2024 capacity to increase in the low-single digits and fourth quarter 2024 capacity to decrease in the low- to mid-single digits, resulting in capacity growth in the range of flat to down low-single digits in second half 2024, all on a year-over-year percentage basis. |

| (c) Operating expenses per available seat mile, excluding fuel and oil expense, special items, and profitsharing (“CASM-X”). |

| (d) Aircraft on property, end of period. The Company now plans for approximately 20 Boeing 737-8 (“-8”) aircraft deliveries and 35 aircraft retirements in 2024, comprised of 31 Boeing 737-700s (“-700”) and four Boeing 737-800s (“-800”). This is compared with its previous plan for approximately 46 -8 deliveries and 49 aircraft retirements. The delivery schedule for the Boeing 737-7 (“-7”) is dependent on the Federal Aviation Administration (“FAA”) issuing required certifications and approvals to The Boeing Company (“Boeing”) and the Company. The FAA will ultimately determine the timing of the -7 certification and entry into service, and Boeing may continue to experience manufacturing challenges, so the Company offers no assurances that current estimations and timelines will be met. |

Revenue Results and Outlook:

- First quarter 2024 operating revenues were a first quarter record $6.3 billion, a 10.9 percent increase, year-over-year

- First quarter 2024 RASM was flat, year-over-year—at the low end of the Company’s previous guidance range

The Company had record first quarter revenue performance driven by strong demand trends and record first quarter passenger and ancillary revenue, passengers carried, and new Rapid Rewards® Members. The Company’s first quarter 2024 RASM came in at the low end of its expectations primarily due to lower-than-expected close-in leisure passenger volume, including lower-than-expected maturation of development markets. Still, nominal sequential RASM in first quarter 2024 was ahead of normal seasonal trends. First quarter 2024 managed business revenues strengthened sequentially, as expected, finishing roughly flat when compared with first quarter 2019 levels, and up approximately 25 percent, year-over-year. Network optimization adjustments, implemented with the March schedule, were accretive and supported the profitability inflection point and strong margins for the month of March 2024.

Based on current booking trends, the Company continues to expect an all-time quarterly record for operating revenue in second quarter 2024. Second quarter 2024 RASM is expected to decrease in the range of 1.5 percent to 3.5 percent, on capacity growth of 8 percent to 9 percent, both year-over-year. The comparison includes just over one point of year-over-year headwind from the combined impact of Easter and 4th of July timing. Once again, the Company currently expects nominal second quarter 2024 sequential RASM trends to exceed normal seasonal trends. This anticipated sequential improvement includes expected benefits from revenue initiatives—most notably a full quarter of network optimization.

Significant challenges presented by Boeing aircraft delivery delays, and the related reduction in second half 2024 capacity, negatively impact the Company’s previous expectation for double-digit year-over-year operating revenue growth for full year 2024. As such, the Company now expects full year 2024 year-over-year operating revenue growth approaching high-single digits when adjusted for current trends and planned reductions for post-summer schedules. While the Company remains committed to the goal of earning its cost of capital, these new challenges, combined with current trend pressures, make it more realistic to expect that to occur beyond 2024. The Company is working on further optimization of its network with the goal to improve unit revenue performance and operating margins5. To that end, the Company has made the difficult decision to cease operations at Bellingham International Airport, Cozumel International Airport, Houston’s George Bush Intercontinental Airport, and Syracuse Hancock International Airport on August 4, 2024, and significantly restructure other markets, most notably by implementing capacity reductions in both Hartsfield-Jackson Atlanta International Airport and Chicago O’Hare International Airport.

The Company’s initiatives, which include the estimated benefit of network changes, are expected to contribute between $1.0 billion and $1.5 billion in 2024 year-over-year pre-tax profits, compared with its initial plan of roughly $1.5 billion. The estimated value has been updated for first quarter actual performance, development market adjustments, and capacity changes in the second half of the year. Furthermore, the Company will continue to evaluate its network and work on its robust set of new strategic initiatives, including revenue generating opportunities.

Fuel Costs and Outlook:

- First quarter 2024 economic fuel costs were $2.92 per gallon1—slightly below the Company’s previous expectations primarily as a result of lower-than-expected refinery margins—and included $0.08 per gallon in premium expense and $0.04 per gallon in favorable cash settlements from fuel derivative contracts

- First quarter 2024 fuel efficiency improved 2.5 percent, year-over-year, primarily due to more -8 aircraft, the Company’s most fuel-efficient aircraft, as a percentage of its fleet

- As of April 18, 2024, the fair market value of the Company’s fuel derivative contracts settling in second quarter 2024 through the end of 2026 was an asset of $270 million

The Company’s multi-year fuel hedging program continues to provide protection against spikes in energy prices. The Company’s current fuel derivative contracts contain a combination of instruments based on West Texas Intermediate and Brent crude oil, and refined products, such as heating oil. The economic fuel price per gallon sensitivities3 provided in the table below assume the relationship between Brent crude oil and refined products based on market prices as of April 18, 2024.

| Estimated economic fuel price per gallon, including taxes and fuel hedging premiums | |||||||||||

| Average Brent Crude Oil price per barrel | 2Q 2024 | 2024 | |||||||||

| $70 | $2.45 – $2.55 | $2.50 – $2.60 | |||||||||

| $80 | $2.65 – $2.75 | $2.70 – $2.80 | |||||||||

| Current Market (a) | $2.70 – $2.80 | $2.70 – $2.80 | |||||||||

| $90 | $2.80 – $2.90 | $2.85 – $2.95 | |||||||||

| $100 | $3.00 – $3.10 | $3.05 – $3.15 | |||||||||

| $110 | $3.10 – $3.20 | $3.15 – $3.25 | |||||||||

| Fair market value of fuel derivative contracts settling in period | $27 million | $109 million | |||||||||

| Estimated premium costs | $39 million | $158 million | |||||||||

| (a) Brent crude oil average market prices as of April 18, 2024, were $87 and $84 per barrel for second quarter and full year 2024, respectively. |

In addition, the Company is providing its maximum percentage of estimated fuel consumption6 covered by fuel derivative contracts in the following table:

| Period | Maximum fuel hedged percentage (a) | ||||||||||||||||||||

| 2024 | 58 % | ||||||||||||||||||||

| 2025 | 47 % | ||||||||||||||||||||

| 2026 | 26 % | ||||||||||||||||||||

| (a) Based on the Company’s current available seat mile plans. The Company is currently 55 percent hedged in second quarter 2024 and 58 percent hedged for second half 2024. |

Non-Fuel Costs and Outlook:

- First quarter 2024 operating expenses increased 12.2 percent, year-over-year, to $6.7 billion

- First quarter 2024 operating expenses, excluding fuel and oil expense, special items, and profitsharing1, increased 16.5 percent, year-over-year

- First quarter 2024 CASM-X increased 5.0 percent, year-over-year—better than the Company’s previous expectations

The Company’s first quarter 2024 CASM-X increased 5.0 percent, year-over-year, approximately one point better than prior guidance primarily due to favorable airport settlements and higher-than-expected participation in voluntary time off programs. The majority of the first quarter CASM-X increase, year-over-year, was attributable to higher 2024 overall labor cost increases, as well as pressure from planned maintenance expenses.

The Company continues to expect similar cost pressures throughout the year, driving second quarter 2024 CASM-X to an expected increase in the range of 6.5 percent to 7.5 percent, year-over-year. The Company expects full year 2024 CASM-X to increase in the range of 7 percent to 8 percent, based on a reduction of roughly 2 points of lower than previously expected capacity, on a year-over-year basis.

First quarter 2024 net interest income, which is included in Other expenses (income), increased $18 million, year-over-year, primarily due to a $16 millionincrease in interest income driven by higher interest rates.

Fleet, Capacity, and Capital Spending:

During first quarter 2024, the Company received five -8 aircraft and retired three -700 aircraft, ending first quarter with 819 aircraft. Given the Company’s discussions with Boeing and expected aircraft delivery delays, the Company plans for approximately 20 -8 aircraft deliveries in 2024, a reduction from the Company’s previous expectation of 46 -8 aircraft deliveries, which differs from its contractual order book displayed in the table below. Consequently, to support fleet flexibility for 2025, the Company plans to retire approximately 35 aircraft in 2024 (31 -700s and four -800s), a reduction from its previous expectation of 49 (45 -700s and four -800s). This will result in a fleet of roughly 802 aircraft at year-end 2024. As a result of Boeing’s delivery delays, the Company has conservatively re-planned its capacity and delivery expectations for the remainder of this year and next. However, there is no assurance that Boeing will meet this most recent delivery schedule.

The Company’s flight schedule is published for sale through March 5, 2025. In light of the Company’s lower aircraft delivery expectations, the Company estimates second quarter 2024 capacity to increase in the range of 8 percent to 9 percent; third quarter 2024 capacity to increase in the low-single digits; fourth quarter 2024 capacity to decrease in the low- to mid-single digits; and full year 2024 capacity to increase approximately 4 percent, all on a year-over-year percentage basis. While the Company continues to adjust and re-optimize schedules for the second half of the year, the current expectation is for aircraft seats and trip frequency to decline in the third and fourth quarters of 2024, both on a year-over-year basis. The Company currently plans for capacity growth beyond 2024 to be at or below macroeconomic growth trends until the Company reaches its long-term financial goal to consistently achieve after-tax return on invested capital (“ROIC”)7 well above its weighted average cost of capital (“WACC”).

The Company’s first quarter 2024 capital expenditures were $583 million, driven primarily by aircraft-related capital spending, as well as technology, facilities, and operational investments. The Company now estimates its 2024 capital spending to be roughly $2.5 billion, which includes approximately $1.0 billion in aircraft capital spending, assuming approximately 20 -8 aircraft deliveries in 2024 and continued progress delivery payments for the Company’s contractual 2025 firm orders.

Last week, the Company entered into a Supplemental Agreement with Boeing relating to its contractual order book for -7 and -8 aircraft. This Supplemental Agreement addresses updates related to the continued -7 delay in certification and supports the Company’s continued focus on fleet modernization. The Supplemental Agreement formalized the conversion of 19 2025 -7 firm orders into -8 firm orders as of March 31, 2024, and shifted one 2025 -8 option into 2026 as of April 2024. The following tables provide further information regarding the Company’s contractual order book and compare its contractual order book as of April 25, 2024, with its previous order book as of January 25, 2024. The contractual order book as of April 25, 2024 does not include the impact of delivery delays and is subject to change based on ongoing discussions with Boeing.

| Current 737 Contractual Order Book as of April 25, 2024: | ||||||||||||||||||||

| The Boeing Company | ||||||||||||||||||||

| -7 Firm Orders | -8 Firm Orders | -7 or -8 Options | Total | |||||||||||||||||

| 2024 | 27 | 58 | — | 85 | (c) | |||||||||||||||

| 2025 | 40 | 19 | 14 | 73 | ||||||||||||||||

| 2026 | 59 | — | 27 | 86 | ||||||||||||||||

| 2027 | 19 | 46 | 25 | 90 | ||||||||||||||||

| 2028 | 15 | 50 | 25 | 90 | ||||||||||||||||

| 2029 | 38 | 34 | 18 | 90 | ||||||||||||||||

| 2030 | 45 | — | 45 | 90 | ||||||||||||||||

| 2031 | 45 | — | 45 | 90 | ||||||||||||||||

| 288 | (a) | 207 | (b) | 199 | 694 | |||||||||||||||

| (a) The delivery timing for the -7 is dependent on the FAA issuing required certifications and approvals to Boeing and the Company. The FAA will ultimately determine the timing of the -7 certification and entry into service, and the Company therefore offers no assurances that current estimations and timelines are correct. |

| (b) The Company has flexibility to designate firm orders or options as -7s or -8s, upon written advance notification as stated in the contract. |

| (c) Includes five -8 deliveries received year-to-date through March 31, 2024. Given the Company’s continued discussions with Boeing and expected aircraft delivery delays, the Company is currently planning for approximately 20 -8 aircraft deliveries in 2024. |

| Previous 737 Order Book as of January 25, 2024 (a): | ||||||||||||||||||||||||

| The Boeing Company | ||||||||||||||||||||||||

| -7 Firm Orders | -8 Firm Orders | -7 or -8 Options | Total | |||||||||||||||||||||

| 2024 | 27 | 58 | — | 85 | ||||||||||||||||||||

| 2025 | 59 | — | 15 | 74 | ||||||||||||||||||||

| 2026 | 59 | — | 26 | 85 | ||||||||||||||||||||

| 2027 | 19 | 46 | 25 | 90 | ||||||||||||||||||||

| 2028 | 15 | 50 | 25 | 90 | ||||||||||||||||||||

| 2029 | 38 | 34 | 18 | 90 | ||||||||||||||||||||

| 2030 | 45 | — | 45 | 90 | ||||||||||||||||||||

| 2031 | 45 | — | 45 | 90 | ||||||||||||||||||||

| 307 | 188 | 199 | 694 | |||||||||||||||||||||

| (a) The ‘Previous 737 Order Book’ is for reference and comparative purposes only. It should not be relied upon. See ‘Current 737 Contractual Order Book’ for the Company’s current aircraft order book. |

Liquidity and Capital Deployment:

- The Company ended first quarter 2024 with $10.5 billion in cash and cash equivalents and short-term investments, and a fully available revolving credit line of $1.0 billion

- The $921 million reduction in cash and cash equivalents during first quarter 2024 was driven primarily by the $1.35 billion payout of the Pilot contract ratification bonus

- The Company continues to have a large base of unencumbered assets with a net book value of approximately $17.2 billion, including $14.4 billion in aircraft value and $2.8 billion in non-aircraft assets such as spare engines, ground equipment, and real estate

- The Company had a net cash position8 of $2.5 billion, and adjusted debt to invested capital (“leverage”)9 of 47 percent as of March 31, 2024

- The Company returned $215 million to its Shareholders through the payment of dividends during first quarter 2024

- The Company paid $8 million during first quarter 2024 to retire debt and finance lease obligations, consisting entirely of scheduled lease payments

Awards and Recognitions:

- Named to FORTUNE’s list of World’s Most Admired® Companies; ranked #39 overall

- Named Domestic Carrier of the Year by the Airforwarders Association

- Named the #2 domestic airline by the 2024 Elliot Readers’ Choice Awards

- Recognized by Newsweek as one of America’s Most Responsible Companies

- Earned Top Score in Human Rights Campaign Foundation’s 2023-2024 Corporate Equality Index

- Designated one of the 25 Best Companies for Latinos to Work 2024 by Latino Leaders Magazine

- Received the following 2024 designations from Viqtory: Military Friendly Employer, Military Spouse Employer, and Military Friendly Supplier Diversity Program

Environmental, Social, and Governance (“ESG”):

- Announced the launch of Southwest Airlines Renewable Ventures (“SARV”), a wholly-owned subsidiary of Southwest Airlines® dedicated to creating more opportunities for Southwest to obtain scalable sustainable aviation fuel (“SAF”), a critical component in the success of the carrier’s goal to replace 10 percent of its total jet fuel consumption with SAF by 2030

- Announced the acquisition of SAFFiRE Renewables, LLC (“SAFFiRE”) as part of the SARV investment portfolio. SAFFiRE expects to utilize technology developed at the Department of Energy’s National Renewable Energy Laboratory (“NREL”) to convert corn stover, a widely available agricultural residue feedstock in the U.S., into renewable ethanol

- Announced a $30 million investment in LanzaJet, Inc., a SAF technology provider and producer with the world’s first ethanol-to-SAF commercial plant, as part of the SARV investment portfolio

- Joined the Hawai’i Seaglider Initiative to explore the feasibility of 100 percent electric, zero direct emissions technology

- Published the Southwest Airlines Climate Advocacy statement

- Celebrated Black History Month and Women’s History Month throughout February and March 2024, respectively. Southwest highlighted its Employee Resource Groups and encouraged Employees to get involved and learn more about cultural, heritage, and pride months

- Highlighted National Human Trafficking Prevention Month to educate Employees and Customers on ways to help combat this issue. Southwest is proud to support multiple nonprofit organizations whose efforts help with the rescue, recovery, and restoration of human trafficking survivors

- Launched applications for the Southwest Scholarship Program, which includes two scholarship opportunities. The Southwest Airlines® Community Scholarship seeks to build a diverse talent pipeline, while inspiring future generations to find careers within the airline industry. The Southwest Airlines® Founders Scholarship was established for eligible dependents of Southwest Airlines Employees to pursue higher education

- Celebrated the fifth anniversary of Southwest’s service to Hawaii by announcing a partnership with the Council for Native Hawaiian Advancement (“CNHA”) as Presenting Sponsor of the community’s beloved and revitalized Kilohana Hula Show

- Visit southwest.com/citizenship for more details about the Company’s ongoing ESG efforts

Because of the Boeing delivery delays, Southwest will drop service to four destinations on August 4, 2024:

Bellingham, WA

Cozumel, Mexico

Houston (Bush Intercontinental), TX

Syracuse, NY

Southwest Airlines aircraft photo gallery:

You must be logged in to post a comment.